income tax efiling malaysia

Malaysias personal income tax year is from 1 January to 31 December and income is assessed on a current year basis. Lanjutan daripada itu pengeluaran.

Electronic Filing Of Personal Income Tax Returns In Malaysia Determinants And Compliance Costs Semantic Scholar

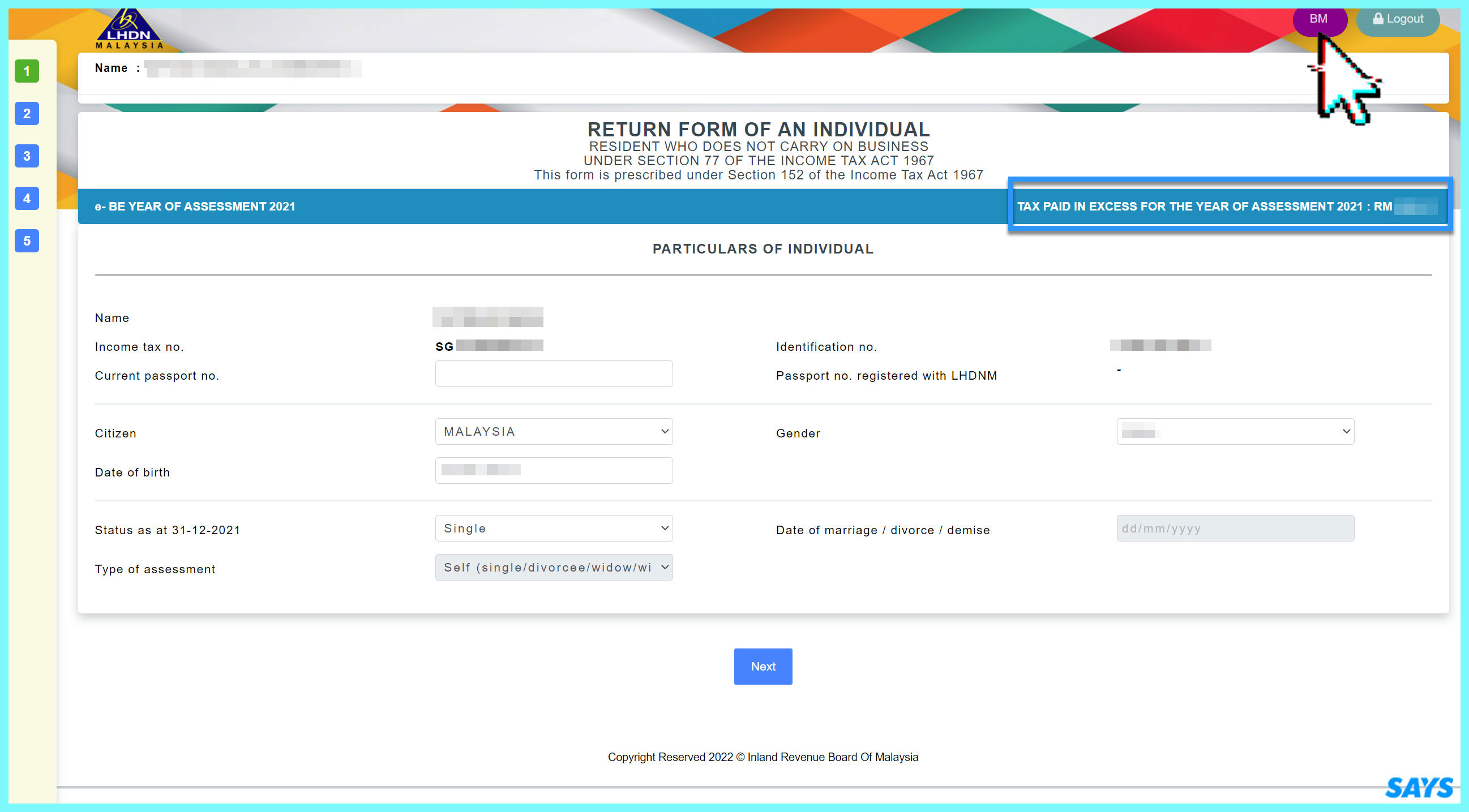

Here are the steps to file your tax through e-Filing.

. Monday to Saturday e-filing and Centralized Processing Center. However if you claimed RM13500 in tax. E-Filing of Income Tax Return or Forms and other value added services.

Here are the full details of all the tax reliefs that you can claim for YA 2021. The deadline for filing income tax in Malaysia also varies according to what type of form you are filing. The tax filing deadline for person not carrying on a business is by 30.

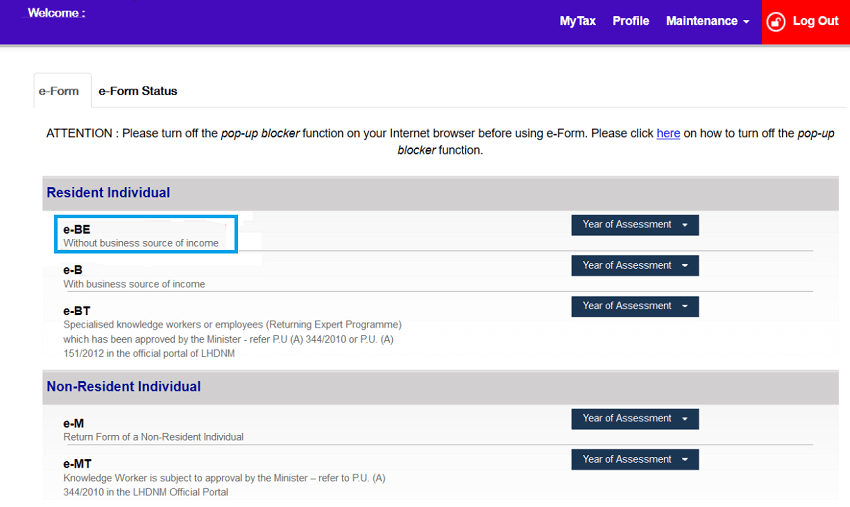

Adalah dimaklumkan bahawa Lembaga Hasil Dalam Negeri Malaysia LHDNM akan menaik taraf sistem atas talian bagi membolehkan akses berterusan ke semua sistem LHDNM. E-Filing Home Page Income Tax Department Government of India. Head over to ezHASIL website.

Kindly click on the following link. Pegangan Dan Remitan Wang Oleh Pemeroleh. The submission of Return Form RF for Year Assessment 2021 via e-Filing for Forms E BE B M BT MT P TF and TP Forms commences on March 1st 2022.

If you have never filed your taxes before on e-Filing income tax Malaysia 2022 go to httpsedaftarhasilgovmy and. 1800 180 1961or 1961. If youd like to retrieve it online head over to the LHDN Maklum Balas Pelanggan Customer Feedback website.

Pengemukaan Borang Nyata BN Tahun Saraan 2021 dan Tahun Taksiran 2021 melalui e-Filing bagi Borang E BE B M BT MT P TF dan TP boleh dilakukan mulai 01 Mac 2022. For the BE form resident individuals who do not carry on business the. Based on this amount your tax rate is 8 and the total income tax that you must pay amounts to RM1640 RM600 RM1040.

30062022 15072022 for e-filing 6. Mulai 18 Mac 2019 Lembaga Hasil Dalam Negeri Malaysia LHDNM tidak lagi menerima permohonan untuk Sijil Taraf Orang Kena Cukai STOKC. How to apply to file my income tax online for 2022.

As a general rule anyone earning a salary in Malaysia is required to pay income tax unless they fall into one of the exceptions. Imposition Of Penalties And Increases Of Tax. Granted automatically to an individual for.

Assessment Of Real Property Gain Tax. 03-8911 1000 Dalam Negara 603-8911 1100 Luar Negara. A non-resident individual is taxed at a flat rate of 30 on total taxable income.

Click on Permohonan or Application depending on. For the most part foreigners working in. Companies limited liability partnerships trust bodies and cooperative societies which are dormant andor have not commenced business are required to register and furnish Form E with.

Form P Income tax. The employment income receivable in the following year whether received or not on an individual who has left of will be leaving Malaysia in which he is a non-resident in the following. Tax relief or tax exemption in Malaysia is a system established by the Inland Revenue Board of Malaysia LDHN whereby taxpayers are allowed to deduct a certain amount.

0800 hrs - 2200 hrs. E-Filing Aplikasi e-Filing adalah merupakan sistem yang membolehkan pembayar cukai membuat pengisian dan menghantar Borang Nyata Cukai Pendapatan BNCP dan borang anggaran. Thereafter enter your MyKad NRIC without the dashes and key in your password.

A qualified person defined who is a knowledge worker residing in. Income tax return for individual with business income income other than employment income Deadline. Cancellation Of Disposal Sales Transaction.

The 2022 filing programme stipulates that the Form E and CP8D ie Statement of Remuneration from Employment for the Year ending 31 December 2021 and Particulars of. If this is your first time. 1 Individual and dependent relatives.

How To Step By Step Income Tax E Filing Guide Imoney

Ctos Lhdn E Filing Guide For Clueless Employees

Pdf The Compliance Time Costs Of Malaysian Personal Income Tax System E Filers Vs Manual Filers

Electronic Filing Of Personal Income Tax Returns In Malaysia Determinants And Compliance Costs Semantic Scholar

How To File Income Tax For The First Time

Guide To Using Lhdn E Filing To File Your Income Tax

E Filing Beginners Guide Income Tax Malaysia 2022 Youtube

Assessing E Government Services The Case Of E Filing Of Personal Income Tax In Malaysia Government Law Book Chapter Igi Global

9 Income Tax Ideas Income Tax Income Tax

E Filing Beginners Guide Q A Part 1 Income Tax Malaysia 2022 Youtube

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

E Filing Beginners Guide Income Tax Malaysia 2022 Youtube

How To File Your Taxes For The First Time

Psa Lhdn Extends Income Tax Filing Deadline To 30th June Soyacincau

Income Tax E Filing Guide Mypf My

Ctos Lhdn E Filing Guide For Clueless Employees

Electronic Filing Of Personal Income Tax Returns In Malaysia Determinants And Compliance Costs Semantic Scholar

.jpg)

Income Tax Returns For 2019 Can Be Submitted Via E Filing Starting March 1 Malay Mail

Cara Isi E Filing 2022 Panduan Lengkap Claim Income Tax Borang Be Semakan Malaysia

0 Response to "income tax efiling malaysia"

Post a Comment